History Lesson: Tax Cuts Are No Magic Bullet

No idea is more central to conservative economic thinking than the belief that cutting taxes leads to higher economic growth. One can certainly understand the appeal of this belief: It would be great if government could collect the same amount of revenue, but with much lower tax rates, because those rates fostered strong growth.

Alas, the historical record doesn't offer much validation of this sunny supply-side vision -- as I have noted here repeatedly. David Leonhardt discussed the record yesterday in the New York Times. One interesting point he noted was that cutting taxes may make a difference when taxes are extremely high, but the rate changes of recent years are relatively small and thus it's no surprise that the effects would be modest.

Listening to today's tax debate, you'd think our political leaders were debating capitalism vs. socialism. In fact, though, going back to the Clinton-era tax rates would mean raising the top income tax bracket by less than 5 percent. That's not going to fundamentally change behavior.

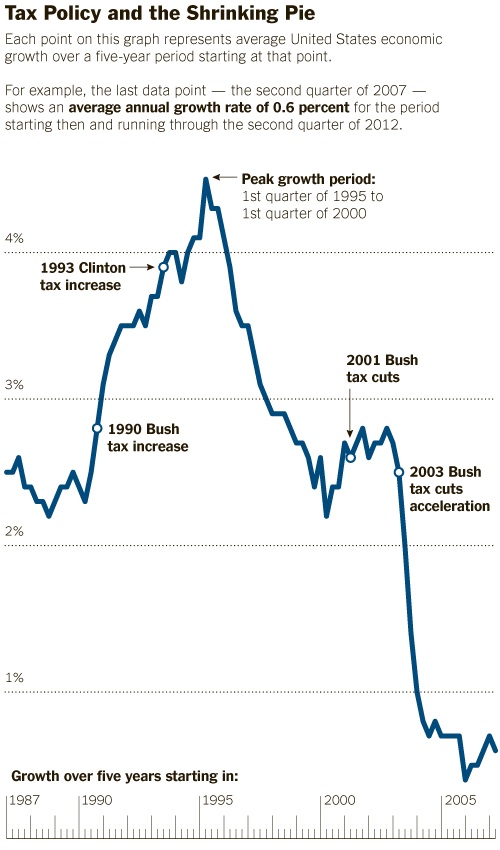

Leonhardt's article was accompanied by a telling chart that pretty much sums up the disconnect between taxes and growth.

|

|

|

|

|